4 Generations Are Persevering Against Headwinds and Uncertainties to Prepare for Retirement

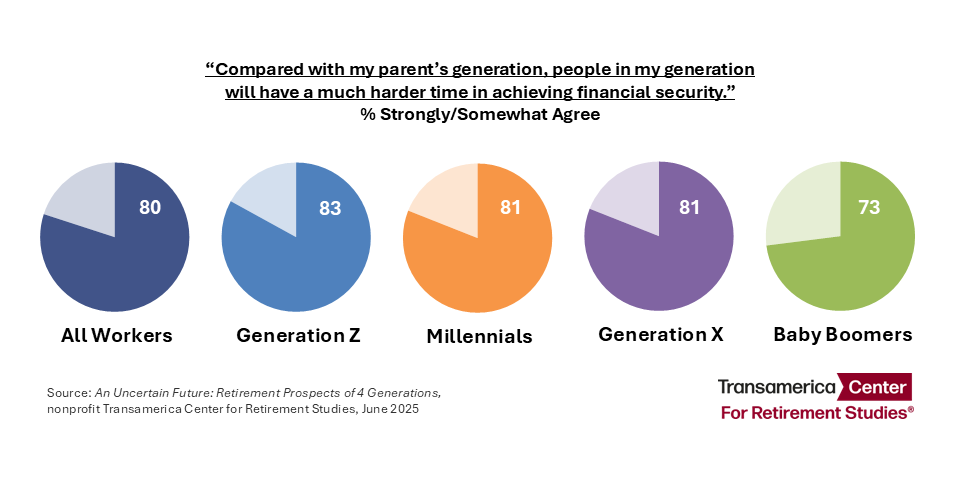

LOS ANGELES – June 18, 2025 – Eight in 10 U.S. workers (80%) agree with the statement, “Compared with my parent’s generation, people in my generation will have a much harder time achieving financial security,” according to An Uncertain Future: Retirement Prospects of 4 Generations, a survey-based research report released today by nonprofit Transamerica Center for Retirement Studies® (TCRS) in collaboration with Transamerica Institute®.

“The single most important ingredient for workers to achieve a financially secure retirement is access to meaningful employment with retirement benefits throughout their working years,” said Catherine Collinson, CEO and president of Transamerica Institute and TCRS. “Amid workforce transformations and the evolving retirement landscape, resilience is imperative. Workers must have the know-how and resources needed to navigate an uncertain future.”

“The single most important ingredient for workers to achieve a financially secure retirement is access to meaningful employment with retirement benefits throughout their working years,” said Catherine Collinson, CEO and president of Transamerica Institute and TCRS. “Amid workforce transformations and the evolving retirement landscape, resilience is imperative. Workers must have the know-how and resources needed to navigate an uncertain future.”

Generation Z (Born 1997 to 2012)

“Generation Z workers are embarking on their careers in tumultuous times. They have experienced higher rates of unemployment in recent years compared with older generations. Now, they are contending with prolonged labor market volatility – while many are also being called upon to support their elders,” said Collinson. “Generation Z workers are working all the angles by taking on side hustles in the gig economy, and they are stretched to their limits.”

Among Generation Z workers who are age 18 and older, the survey finds:

Almost six in 10 Generation Z workers (59%) often feel exhausted and burnt out. Thirty-two percent have more than one job and 59% have a side hustle.

Forty-one percent of Generation Z workers are either currently serving or have served as caregivers for a relative or friend during their working careers – often for a grandparent or parent. Among these caregivers, nine in 10 (90%) have made one or more adjustments to their work situation as a result of becoming a caregiver, ranging from missing days of work and reducing hours to forgoing a promotion or quitting a job altogether.

Future employability is top of mind for many Generation Z workers. More than half (52%) are worried that AI and robotics will make their job skills no longer needed.

Generation Z workers’ current financial priorities include paying off debt (55%), saving for a major life event (46%), just getting by to cover basic living expenses (41%), building emergency savings (40%), and saving for retirement (32%). A noteworthy 23% cite supporting their parents as a financial priority.

Despite these competing priorities, three in four Generation Z workers (76%) are saving for retirement through 401(k) or similar plans and/or outside the workplace – and they started saving at age 20 (median). Those participating in a 401(k) or similar plan currently contribute 15% (median) of their annual pay.

Generation Z workers have saved $31,000 (estimated median) in total household retirement accounts and only $2,000 (median) in emergency savings. One in four (26%) have dipped into their retirement savings by taking a hardship withdrawal or early withdrawal from a 401(k) or similar plan or IRA.

“Generation Z is already saving for retirement and they have many decades to work, save, and grow their savings. They need to continue investing in their human capital through lifelong learning, keeping their job skills up to date, and safeguarding their physical and mental health,” said Collinson.

Millennials (Born 1981 to 1996)

“Millennials are currently in their late twenties to mid-forties. They are feeling the crunch in their ‘sandwich years’ of juggling employment, raising children, and caring for aging parents. With such pressing priorities, it could be tempting to procrastinate with their long-term retirement preparations,” said Collinson.

Almost six in 10 Millennial workers (58%) are still financially recovering from the pandemic and its aftermath. Forty-nine percent indicate they are having trouble making ends meet, and 59% indicate debt is interfering with their ability to save for retirement.

Forty-one percent of Millennial workers are currently serving and/or have served as caregivers for a relative or friend during their careers – most typically a parent. Among caregiving Millennials, almost nine in 10 (89%) made one or more adjustments to their employment.

Millennial workers’ current financial priorities include paying off debt (62%), saving for retirement (55%), building emergency savings (46%), supporting children (43%), and saving for a major life event (40%). Seventeen percent cite supporting parents as a financial priority.

Eighty-five percent of Millennial workers are saving for retirement in a 401(k) or similar plan and/or outside the workplace. They began saving at age 26 (median). Those participating in a 401(k) or similar plan currently contribute 10 percent (median) of their annual pay.

Millennial workers have saved $65,000 (estimated median) in total household retirement accounts and only $5,000 (median) in emergency savings. Almost one in four (24%) have taken a hardship withdrawal or early withdrawal from a 401(k) or similar plan or IRA.

“Millennials are still two to three decades away from retirement – which gives them some time to save and grow their savings. Right now, they should start creating financial plans that reflect their goals and aspirations as well as their priorities and realities,” said Collinson.

Generation X (Born 1965 to 1980)

“Generation X begins turning 60 this year and they are behind on their savings. Retirement is a light on the horizon, growing closer and brighter. Many plan to work beyond the traditional retirement age to earn income and bridge savings gaps, but their success will depend on how well they maintain their health and employability,” said Collinson.

Only 18% of Generation X workers are very confident they will be able to fully retire with a comfortable lifestyle, and just 23% “strongly agree” that they are building a large enough retirement nest egg.

Thirty-nine percent expect to retire at age 70 or older or do not plan to retire, and 56% plan to continue working in retirement.

Eighty-two percent of Generation X workers are saving for retirement in a 401(k) or similar plan and/or outside the workplace. They began saving at age 30 (median). Those participating in a 401(k) or similar plan currently contribute 10 percent (median) of their annual pay.

Half of Generation X workers (50%) expect their primary source of retirement income to come from self-funded savings, including 401(k)s, 403(b)s, and IRAs (39%) or other savings and investments (11%). Twenty-eight percent expect to primarily rely on Social Security. Seventy-seven percent are concerned that Social Security will not be there for them when they are ready to retire.

Generation X workers have saved $107,000 (estimated median) in total household retirement accounts and $6,500 in emergency savings. Seventeen percent have dipped into their retirement savings by taking a hardship withdrawal or early withdrawal.

Only 25% of Generation X workers have a written financial strategy for retirement.

“For Generation X, the road to a financially secure retirement has been circuitous. Back in the 1980s and 1990s, when they entered the workforce, the retirement landscape was quietly shifting away from traditional pensions toward 401(k) plans. It was unknown at that time how profound the implications of this shift would be. Among Generation Xers who were fortunate enough to be offered a 401(k) plan in the early years of their career, many were unaware of the importance of saving,” said Collinson.

Baby Boomers (Born 1946 to 1964)

“Baby Boomers are now in their early sixties to late seventies. They have rewritten societal rules at every stage in life, including retirement,” said Collinson. “Among those still in the workforce, Baby Boomers are stretching the boundaries of working later in life. However, they are vulnerable to health and employment issues, so they need contingency plans in case retirement comes unexpectedly.”

Almost six in 10 Baby Boomer workers (57%) expect to retire at age 70 or older or do not plan to retire. Their greatest retirement fears are declining health that requires long-term care (49%), outliving their savings and investments (44%), and that Social Security will be reduced or cease to exist in the future (44%).

Almost four in 10 Baby Boomer workers (39%) expect Social Security to be their primary source of retirement income, while 30% expect to rely on income from 401(k)s, 403(b)s, and IRAs, and 11% from other savings and investments. Seven percent expect their primary source of retirement income to come from continued work and 7% expect it to come from a company-funded pension plan.

Eighty-five percent of Baby Boomer workers are saving for retirement in a 401(k) or similar plan and/or outside the workplace. They began saving at age 35 (median). Those participating in a 401(k) or similar plan currently contribute 10% (median) of their annual pay.

Baby Boomer workers have saved $270,000 (estimated median) in total household retirement accounts and $20,000 (median) in emergency savings. Twelve percent have taken a hardship withdrawal or early withdrawal from a 401(k) or similar plan or IRA.

Just 27% of Baby Boomer workers have a written financial strategy for retirement, and only 38% have a backup plan for income if forced into retirement sooner than expected.

“Baby Boomers have not enjoyed the same amount of time to save in 401(k)s compared with younger generations. They were already mid-career when 401(k) plans were introduced, so they got a later start on their retirement savings journey. Now, many are making up for lost time,” said Collinson.

A Call to Action

Almost seven in 10 workers (68%) across generations feel they could work until retirement and still not save enough to meet their needs. Yet they may be overlooking opportunities that could help improve their outcomes. While more than half of workers (58%) would prefer to rely on outside experts to monitor and manage their retirement savings, only 35% currently use a professional financial advisor. Just one in five workers (22%) have “a lot” of working knowledge about personal finance. Even if workers were to fully maximize these opportunities, they still need support from policymakers to achieve a secure retirement.

“The strength of the U.S. retirement system relies on a robust economy, labor force, and employment market – an environment that is conducive for workers to earn income and save for the future. With today’s accelerating pace of change, policymakers can help ensure that workers don’t get left behind,” said Collinson. “Policymakers can also make it even easier and more affordable for employers to offer retirement benefits to their employees. At the same time, Social Security and Medicare have funding issues that are begging to be solved. Workers are paying into these programs with expectations of receiving the benefits they have been promised.”

An Uncertain Future: Retirement Prospects of 4 Generations is part of TCRS’ 25th Annual Retirement Survey, one of the largest and longest-running surveys of its kind. The report examines the retirement outlook of workers aged 18 and older who are employed by for-profit companies. It provides detailed survey findings and contextual perspectives about the retirement preparedness of Generation Z, Millennials, Generation X, and Baby Boomers. It provides recommendations to workers, employers, and policymakers. To download the report and other research, visit www.transamericainstitute.org. Follow on LinkedIn, Facebook, and X @TI_insights and @TCRStudies.

About Transamerica Center for Retirement Studies

Transamerica Center for Retirement Studies® (TCRS) is a division of Transamerica Institute®, a nonprofit, private operating foundation. TCRS conducts one of the largest and longest-running annual retirement surveys of its kind. The information provided here is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical, or financial advice or guidance. Please consult independent professionals for answers to your specific questions.

About the 25th Annual Transamerica Retirement Survey

The analysis contained in An Uncertain Future: Retirement Prospects of 4 Generations was prepared internally by the research team at Transamerica Institute and TCRS. It is based on an online survey conducted within the U.S. by The Harris Poll on behalf of Transamerica Institute and TCRS between September 11 and October 17, 2024, among a nationally representative sample of 10,009 adults and an oversample of 2,008 workers in a for-profit company employing one or more employees. The data in this press release is shown for a subsample of 5,493 workers in a for-profit company employing one or more employees including 702 Generation Z, 2,271 Millennials, 1,808 Generation X, 691 Baby Boomers, and 21 Silent Generation. Data was weighted where necessary for age by gender, race/ethnicity, region, education, marital status, household size, household income, and smoking status. Respondents were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval and the worker sample data is accurate to within ±1.7 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. Percentages are rounded to the nearest whole percent.

4571557 06/25