Social Security Is the Cornerstone of Retirement Income

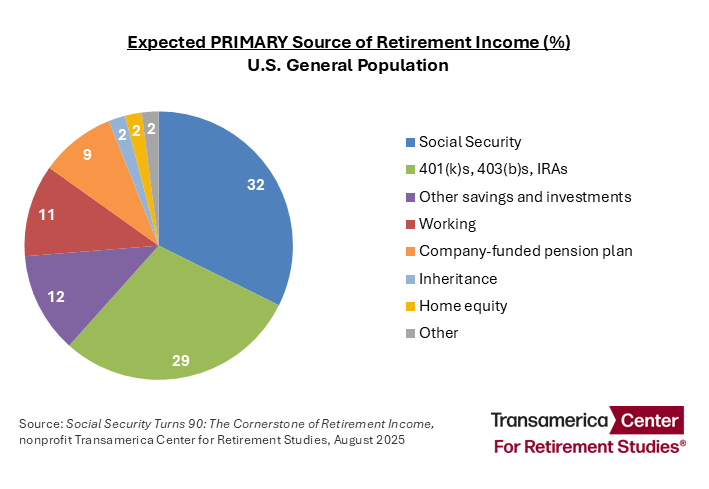

LOS ANGELES – August 14, 2025 – Almost seven in 10 Americans (69%) are expecting Social Security as a source of retirement income, and 32% expect it will be their primary source of retirement income, according to Social Security Turns 90: The Cornerstone of Retirement Income, a survey-based research report released today by nonprofit Transamerica Center for Retirement Studies® (TCRS) in collaboration with Transamerica Institute®. To commemorate Social Security’s 90th anniversary, TCRS published Social Security Turns 90: The Cornerstone of Retirement Income to highlight the program’s vital role in helping Americans achieve a more secure retirement. The report examines people’s beliefs, expectations, and reliance on Social Security. It also sheds light on their views on how to address its funding shortfalls.

To commemorate Social Security’s 90th anniversary, TCRS published Social Security Turns 90: The Cornerstone of Retirement Income to highlight the program’s vital role in helping Americans achieve a more secure retirement. The report examines people’s beliefs, expectations, and reliance on Social Security. It also sheds light on their views on how to address its funding shortfalls.

“Social Security has served as the cornerstone of retirement income since its establishment nine decades ago. It provides millions of older Americans with guaranteed income, so that they can retire with greater financial security,” said Catherine Collinson, CEO and president of Transamerica Institute and TCRS. “With the estimated depletion of the Social Security trust funds looming large, now is the time for policymakers to identify reforms that can help ensure the program’s sustainability for the next 90 years.”

How to address Social Security’s funding shortfall

“Americans are anxious about the future of Social Security and what might happen to their benefits,” said Collinson. Among those who are not yet retired, seven in 10 people (71%) are concerned that Social Security will not be there for them when they are ready to retire.

Amid widespread concerns about Social Security, the survey asked people how Congress should address its projected funding shortfall. Only 5% of people said that Congress should “do nothing.” People’s responses for specific reforms include increasing the maximum earnings subject to payroll taxes (38%), increasing the Social Security payroll tax rate (35%), preserving retirement benefit payments for retirees in greatest need (28%), and raising the retirement age (22%). One in four people (25%) say they “don’t know.”

Current and future retirees are counting on Social Security

“Americans are counting on Social Security for retirement income to complement their employer-sponsored retirement benefits and personal savings,” said Collinson.

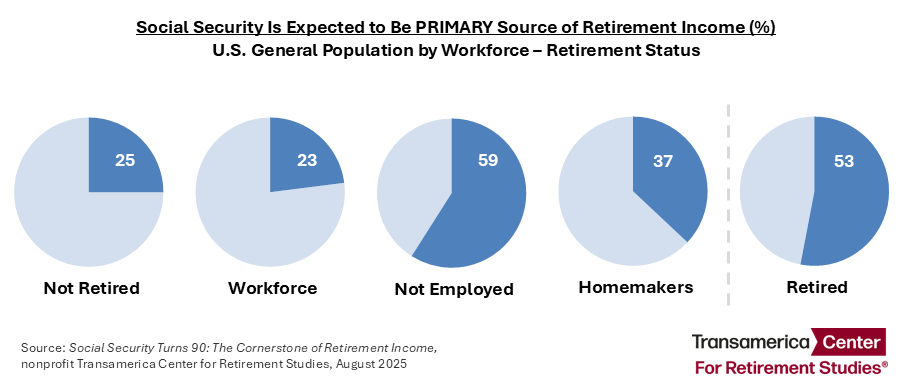

More than half of retirees (53%) indicate Social Security will be their primary source of income throughout their retirement. Among those who are not yet retired, one in four people (25%) expect their primary source of retirement income to be Social Security, including 23% of people in the workforce, 59% of people who are not employed and not looking for work, and 37% of homemakers.

The survey findings further illustrate the importance of Social Security for people’s retirement security:

The survey findings further illustrate the importance of Social Security for people’s retirement security:

- Seven in 10 people who are not yet retired (70%) agree with the statement, “I feel that I could work until retirement and still not save enough to meet my needs,” and 42% of retirees indicate that they were unable to save enough to meet their retirement needs.

- People who are not yet retired have saved $51,000 in total household retirement accounts, including people in the workforce ($65,000), homemakers ($16,000), and the unemployed who are not looking for work ($0) (estimated medians).

- Retirees have $126,000 in total household savings excluding home equity (estimated median).

People in low- to moderate-income households are more reliant on Social Security

“Social Security is a meaningful source of retirement income for Americans across the wealth spectrum, and it is a lifeline for retirees with limited means,” said Collinson.

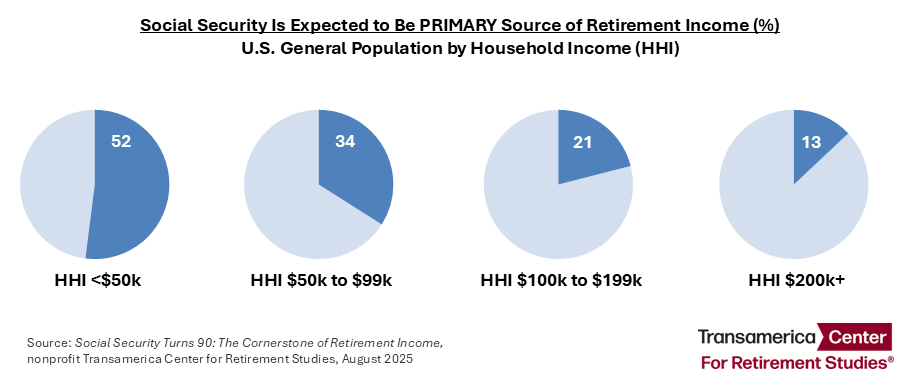

Reliance on Social Security varies dramatically by household income (HHI). More than half of people with a HHI of <$50k (52%) expect Social Security to be their primary source of retirement income compared with 34% of those with a HHI of $50k to $99k, 21% of HHI of $100k to $199k, and 13% of HHI $200k+. Social Security reliance is especially prevalent among retirees with a HHI of < $100k.More than eight in 10 retirees with a HHI of <$50k (85%) and more than half of retirees with a HHI $50k to $99k (54%) cite Social Security as their primary source of retirement income.

Social Security reliance is especially prevalent among retirees with a HHI of < $100k.More than eight in 10 retirees with a HHI of <$50k (85%) and more than half of retirees with a HHI $50k to $99k (54%) cite Social Security as their primary source of retirement income.

The survey findings highlight the importance of Social Security, especially for people at the lower end of the income spectrum:

- Three in four people with a HHI of <$50k (76%) agree they could work until retirement and not save enough to meet their needs or, if retired, indicate they were unable to save enough. Such concerns are less prevalent as HHI increases.

- Among those who are not yet retired, people with a HHI of <$50k have saved just $2,000 in household retirement accounts, while those with a HHI of $50k to $99k have saved $33,000, those with HHI of $100k to $199k have saved $147,000, and those with HHI of $200k+ have saved $565,000 (estimated medians).

- Retirees with a HHI of <$50k have $2,000 in household savings excluding home equity, compared with those with HHI of $50k to $99k who have $130,000, those with HHI of $100k to $199k who have $525,000, and those with HHI of $200k+ who have $997,000 (estimated medians).

Women are more reliant than men on Social Security

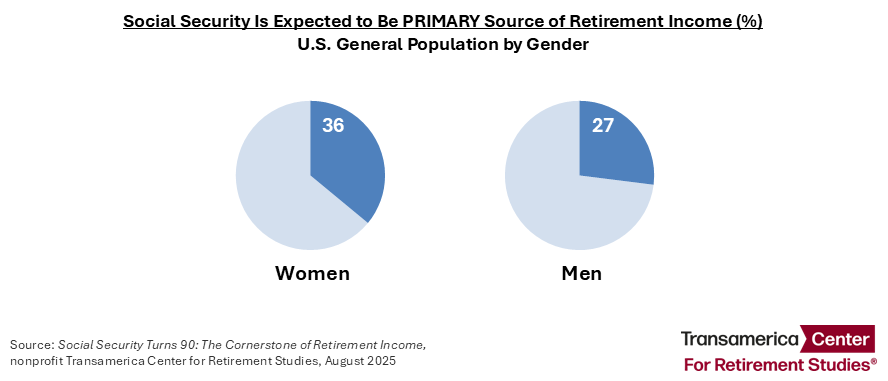

“Women face societal headwinds that make it even more challenging to achieve a financially secure retirement. The persistence of the gender pay gap combined with taking time out of the workforce for parenting and caregiving puts many women at risk of inadequately saving for retirement. As a result, women have greater reliance than men on Social Security for retirement income,” said Collinson.

According to the survey’s findings, women are more likely than men to cite Social Security as their expected primary source of retirement income (36%, 27%, respectively). Reliance on Social Security is even greater among retired women. Almost six in 10 women retirees (59%) cite Social Security as their primary source of income, compared with 47% of men retirees.

Reliance on Social Security is even greater among retired women. Almost six in 10 women retirees (59%) cite Social Security as their primary source of income, compared with 47% of men retirees.

The survey offers insights why women are more reliant than men on Social Security:

- Women are more likely than men to agree that they could work until retirement and still not save enough to meet their needs or, if retired, that they were unable to save enough (67%, 60%, respectively).

- Among those who are not yet retired, women have saved $35,000 and men have saved $67,000 in total household retirement accounts (estimated medians).

- Retired women have saved $79,000 and retired men have saved $185,000 in total household savings excluding home equity (estimated medians).

“Social Security is the cornerstone of retirement income. Americans are paying into Social Security with the expectations of receiving the benefits they have been promised,” said Collinson. “By implementing reforms to address the program’s funding shortfall, policymakers can ensure its sustainability for future generations. The sooner policymakers act, the more time people will have to react and adjust their retirement plans accordingly.”

Social Security Turns 90: The Cornerstone of Retirement Income is part of TCRS’ 25th Annual Retirement Survey, one of the largest and longest-running surveys of its kind. To download the report, visit www.transamericainstitute.org. Follow on LinkedIn, Facebook, and X @TI_insights and @TCRStudies.

About Transamerica Center for Retirement Studies

Transamerica Center for Retirement Studies® (TCRS) is a division of Transamerica Institute®, a nonprofit, private operating foundation. TCRS conducts one of the largest and longest-running annual retirement surveys of its kind. The information provided here is for educational purposes only and should not be construed as insurance, securities, ERISA, tax, investment, legal, medical, or financial advice or guidance. Please consult independent professionals for answers to your specific questions.

About the 25th Annual Transamerica Retirement Survey

The analysis contained in Social Security Turns 90: The Cornerstone of Retirement Income was prepared internally by the research team at Transamerica Institute and TCRS. It is based on an online survey conducted within the U.S. by The Harris Poll on behalf of Transamerica Institute and TCRS between September 11 and October 17, 2024, among a nationally representative sample of 10,009 adults. Data was weighted where necessary for age by gender, race/ethnicity, region, education, marital status, household size, household income, and smoking status. Respondents were selected from among those who have agreed to participate in our surveys. The sampling precision of Harris online polls is measured by using a Bayesian credible interval and the worker sample data is accurate to within ±1.2 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. Percentages are rounded to the nearest whole percent.

4727903 08/25