Medicare

Medicare is a national health insurance program for people 65 or older-- with about 69 million people currently enrolled. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD) or ALS (also called Lou Gehrig's disease). Each year, you can choose which way you get your health coverage (and add or switch drug coverage). It’s important to understand your coverage options and compare the different choices, so you can make an informed decision that’s right for you.

For full details, visit www.medicare.gov.

Click on the links below to learn about Medicare, how to sign up, and what costs to expect.

- When to Enroll?

- How Do I Change My Coverage?

- How Do I Make a Choice?

- What Are My Costs Going to Look Like?

- Understand Your Coverage: Skilled Nursing Facility Care

- Services & Items Not Covered by Part A & Part B Medicare

- Recent Changes to Medicare

- Get Help

When to Enroll?

You can only enroll in Medicare during certain periods:

- Initial Enrollment Period

- General Enrollment Period

- Special Enrollment Period

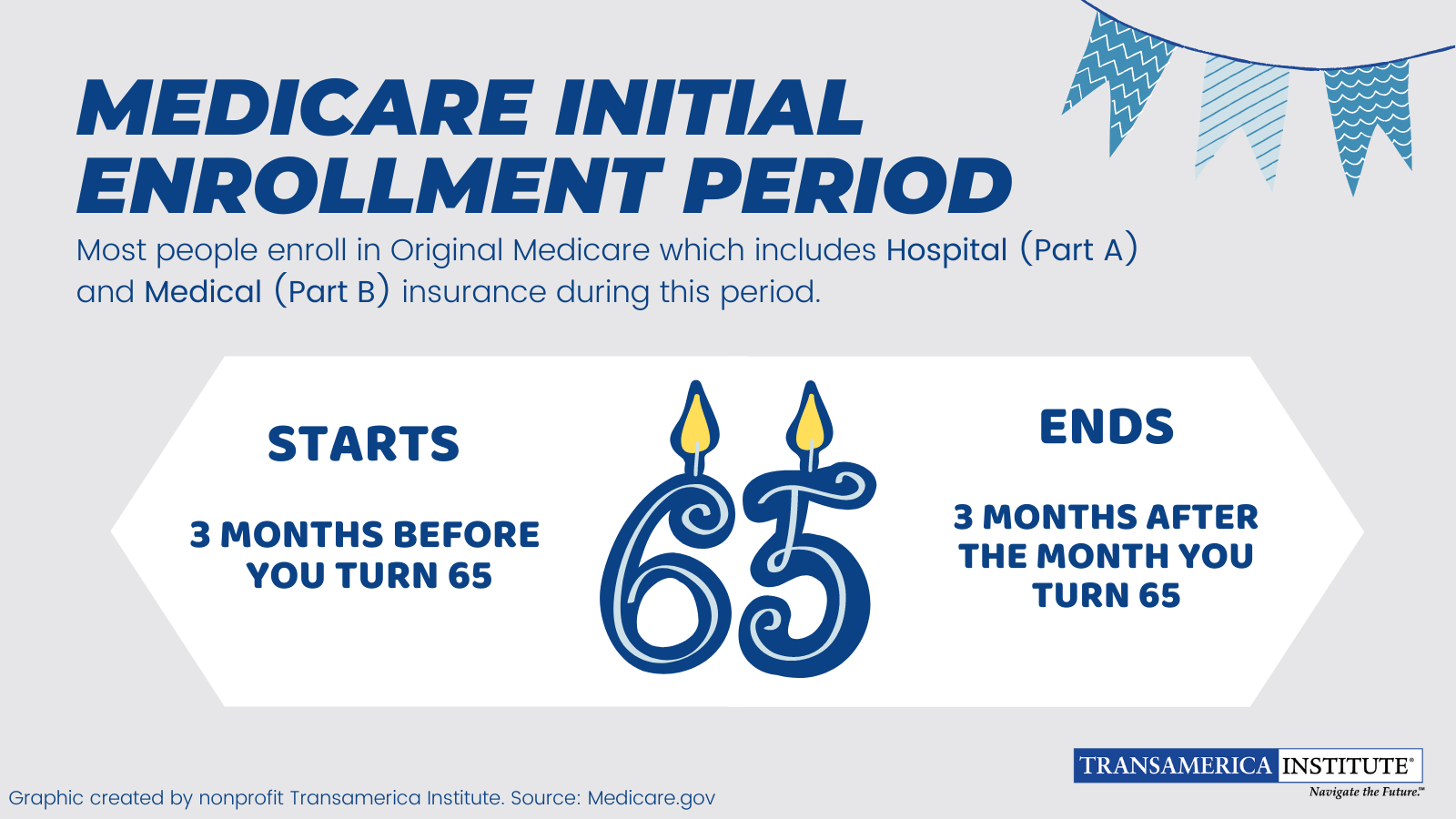

Initial Enrollment Period

You must initially enroll in Medicare during the 7-month period that starts 3 months before the month you turn 65, includes the month you turn 65, and ends 3 months after the month you turn 65. If you are employed and covered under an employer’s health plan during this time period, consult with your employer’s health plan provider and Medicare to learn what action you must take, if any, at this time.

If you’re close to 65 and are receiving Social Security benefits or Railroad Retirement Board benefits, you’ll be automatically enrolled in Medicare Part A and Part B coverage once you're eligible. Because Part B coverage requires that you pay a monthly premium, you can choose whether to keep it or not.

To learn about coverage options for Medicare, scroll down to the "Which Medicare Plan Do I Choose?" section.

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

General Enrollment Period

If you did not enroll in Medicare when you originally became eligible for it (or during a Special Enrollment Period), you can sign up during the General Enrollment Period (GEP). The GEP takes place January 1 through March 31 each year, with coverage starting July 1. You may face a late penalty for enrolling during the GEP instead of when you first became eligible.

Special Enrollment Period

If you missed the Initial Enrollment Period and the General Enrollment Period, you may qualify for coverage during a Special Enrollment Period under certain circumstances. Contact Medicare to determine if you are eligible.

Ways to Enroll

There are a few ways to enroll in Medicare, depending on which plan you'd like to proceed with. For Original Medicare (Part A & Part B), you can enroll by:

- Applying online at Social Security

- Calling Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778.

- Going in-person to your local Social Security office.

- If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

- Want to know what documents you'll need? Check out the Checklist for Online Medicare, Retirement, & Spouses Applications.

- If you want to enroll in a Medicare Advantage Plan (Part C), enroll directly in the plan through the plan's website or at Medicare.gov.

- If you want a Medicare Supplement Insurance plan (Medigap), you'll enroll directly in the plan through the plan's website.

How Do I Change My Coverage?

Open Enrollment Period

After you've enrolled in Medicare, you can make changes to your health plan during the Open Enrollment Period.

The 2026 Open Enrollment Period runs from Friday, October 15 to Tuesday, December 7, 2025. During this seven-week period, you have a chance to change and review your coverage for 2025. You can sign up for Original Medicare, Medicare Advantage (Part C), add prescription coverage (Part D), or add a Medicare Supplement Insurance (Medigap) plan.

Visit Medicare.gov to change your Medicare plan during the Open Enrollment Period.

Medicare Advantage Open Enrollment Period

January 1 – March 31, 2026, is the Medicare Advantage Open Enrollment Period. If you’ve enrolled in a Medicare Advantage Plan during the Open Enrollment Period and change your mind, you can switch to Original Medicare (Parts A & B) or to a different Medicare Advantage Plan during this time.

Which Medicare Plan Do I Choose?

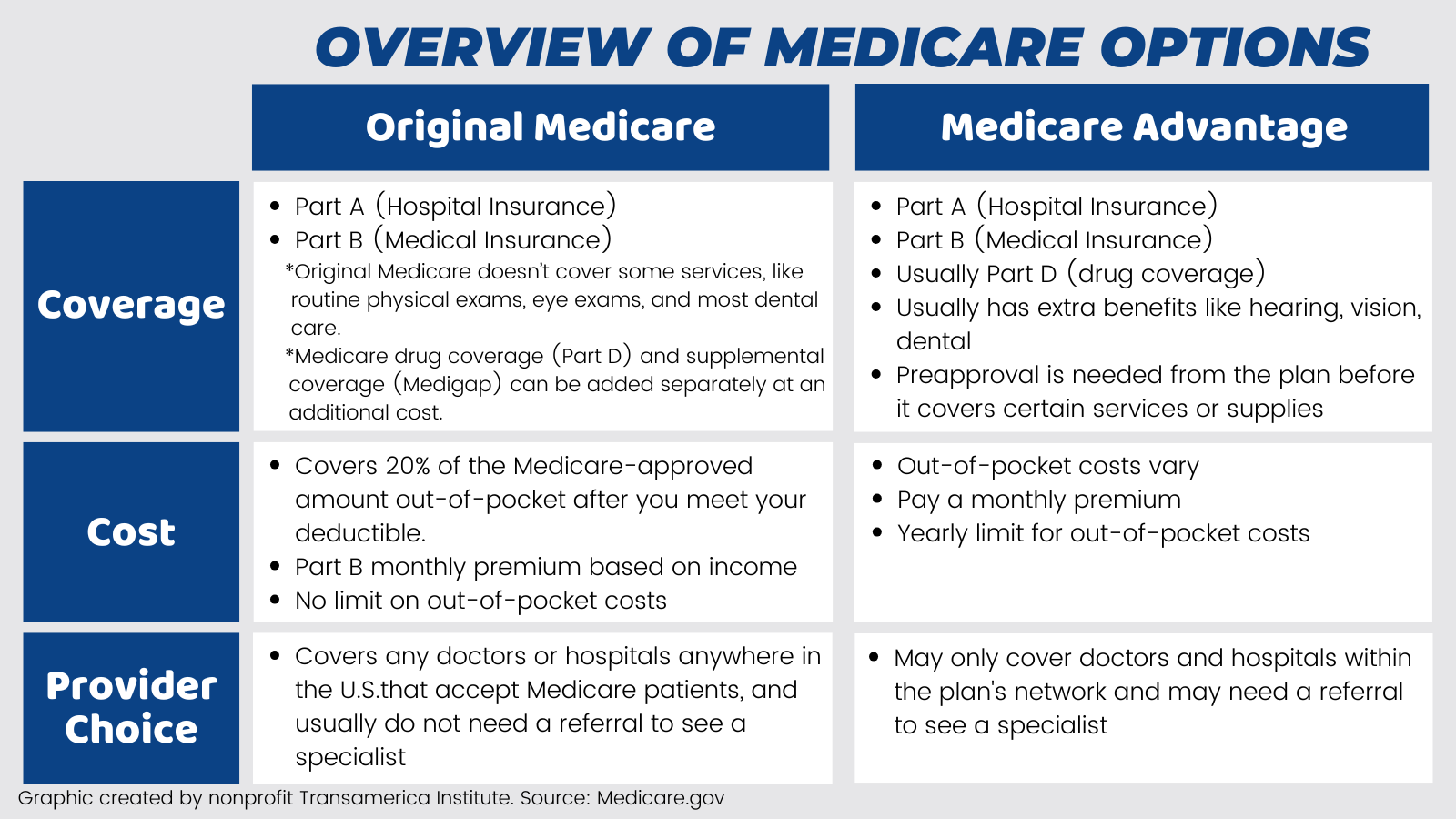

When you first enroll in Medicare, you can choose how you get your Medicare coverage. There are two options for you to pick from:

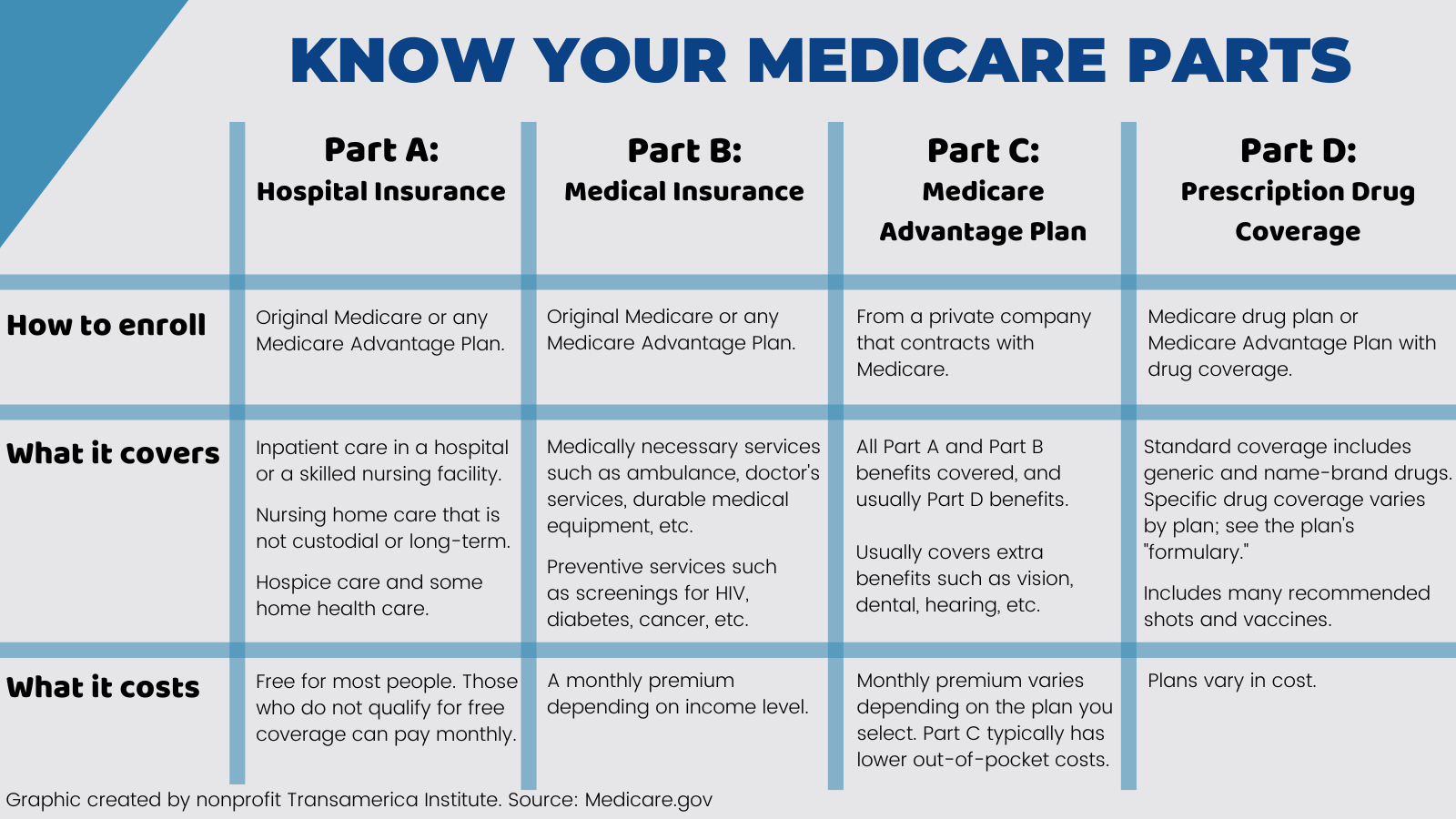

1.) Original Medicare includes Hospital (Part A) and Medical (Part B) insurance. To add drug coverage, you can add Part D. Additionally, adding a Medicare Supplement Insurance (Medigap) policy will help lower your out-of-pocket costs.

2.) Medicare Advantage (Part C) is an alternative to Original Medicare, and is purchased through private insurance companies. These plans include Part A, Part B, and usually Part D. Most plans have additional benefits — hearing, vision, dental, and more.

You can change your Medicare coverage during the Medicare Open Enrollment Period or the Medicare Advantage Open Enrollment Period.

How Do I Make a Choice?

There are many choices when it comes to picking a Medicare plan that works for you. See below to get a high level summary of Part A, Part B, Medicare Advantage (Part C), and Part D. You'll see information such as what the plan covers, what it costs, and how to enroll.

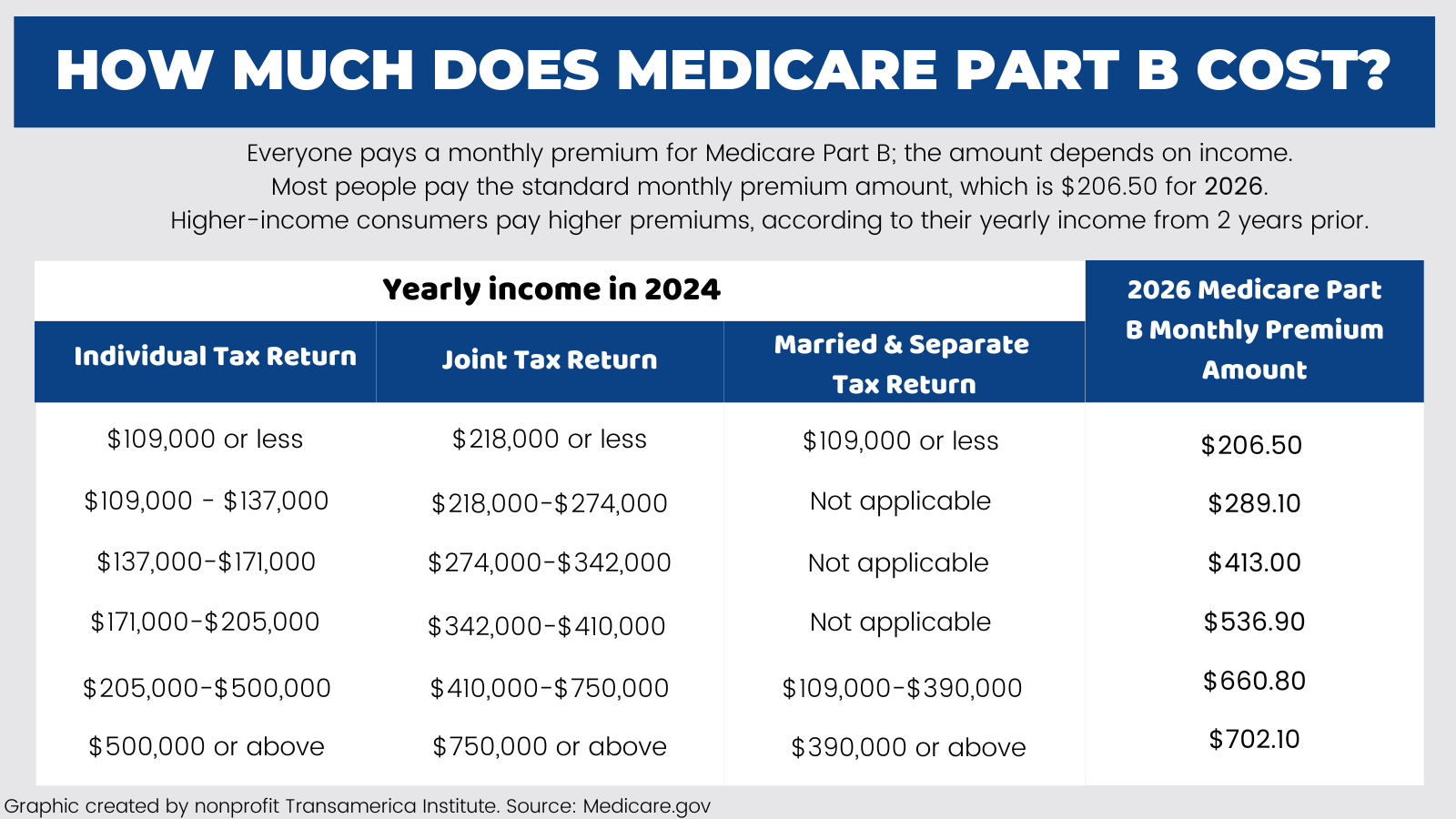

What Are My Costs Going to Look Like?

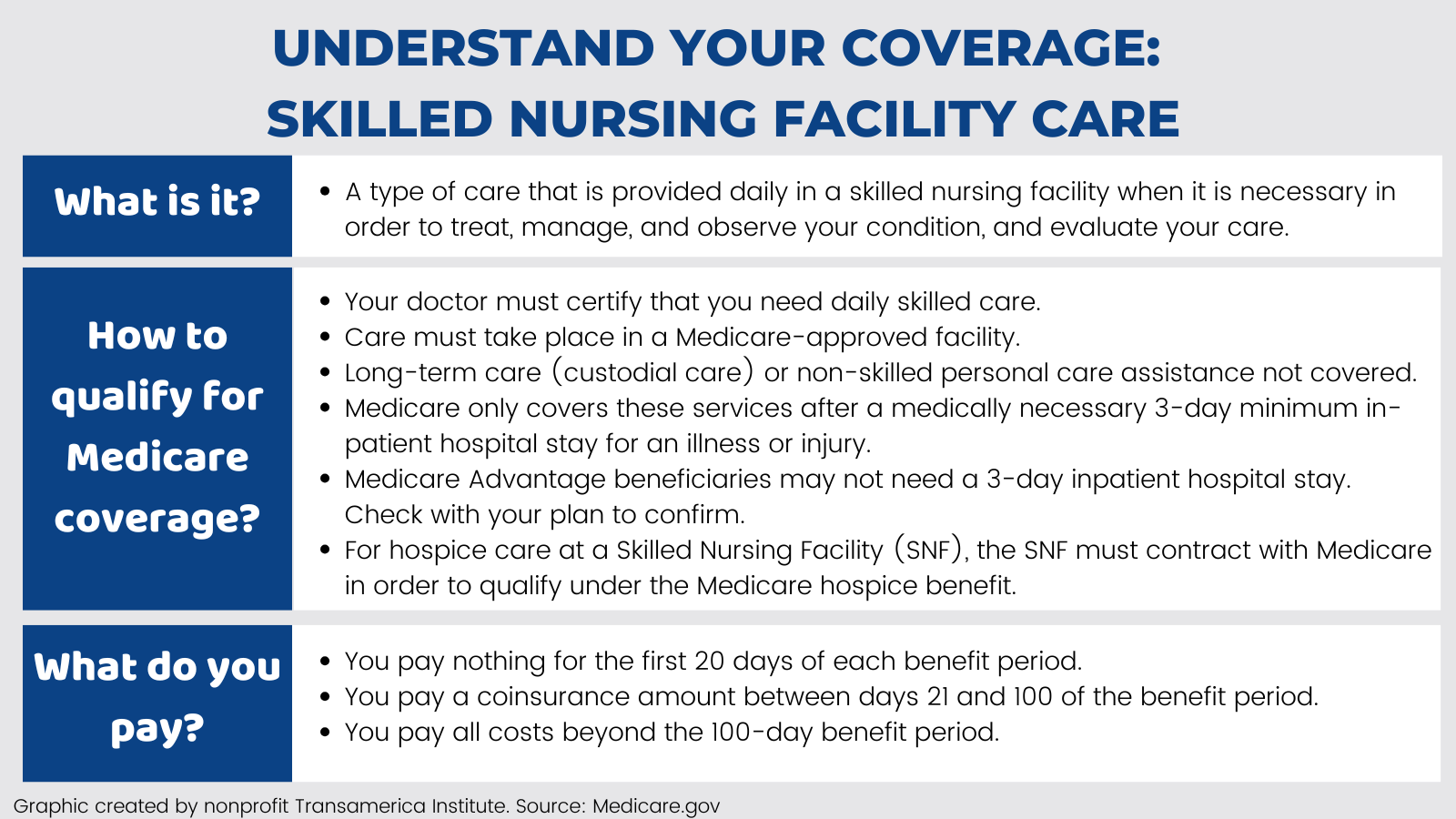

Understand Your Coverage: Skilled Nursing Facility Care

Services & Items Not Covered by Original Medicare (Parts A & B)

- Long-term care (also known as “custodial care” and includes activities like bathing, dressing, using the bathroom, and eating)

- Most dental care

- Eye exams related to prescribing glasses

- Dentures

- Routine foot care

- Cosmetic surgery

- Message therapy

- Routine physical exams

- Hearing aids and exams to fit them

- Concierge care (also called concierge medicine, retainer-based medicine, boutique medicine, platinum practice, or direct care)

Recent Changes to Medicare

Lowering your prescription drug costs

There will be a 2026 cap on prescription drugs. If you have Medicare Part D (drug coverage), your annual out-of-pocket costs will be capped at $2,100. Once you reach that cap, you'll pay nothing for covered Part D medications for the rest of the year. The maximum Part D deductible will increase from $590 in 2025 to $615 in 2026. The $35 monthly cap on insulin costs is still in effect, and most vaccines will be covered under Part D.

Expansion of artificial intelligence

An artificial intelligence tool will be available to help patients compare prescription drug prices across different pharmacies.

Six states —Arizona, New Jersey, Oklahoma, Washington, Ohio, and Texas— will begin using an AI-assisted program to determine coverage of specific medical services provided to people who have Medicare plans that don’t include a Medicare Advantage supplement.

Potential changes to telehealth coverage

It is projected that telehealth flexibilities will return to pre-pandemic regulations in 2026 unless extended by Congress. Many services provided to patients through telehealth in their homes will no longer be covered.

Check out the Medicare & You 2026 Handbook for more information.

Get Help

Medicare.gov is the official government site for Medicare.

State Health Insurance Assistance Program (SHIP). Free, unbiased counseling is available in every state.

Medicare Plan Finder. An online tool that guides you through the process of shopping for and comparing plans.

Insurance brokers. They give free advice; however, they may receive financial compensation for the plans they represent.

Fee-based consultants. These consultants have no ties to health insurance companies or health care providers and are compensated per hour or project.

Ask Claire. A free Medicare resource that connects you with licensed representatives for general medicare questions.